Social security taken out of paycheck

The government has a. The Social Security tax rate in the United States is currently 124.

2022 Wage Cap Jumps To 147 000 For Social Security Payroll Taxes

1 and continuing through the end of the year.

. If your employer does not withhold Social Security tax. Social Security Offers Information on How to Plan for Your Retirement. Its true that payroll taxes wont be taken out of some taxpayers paychecks beginning Sept.

Its the federal law that requires employers to pay and withhold certain taxes from the wages they pay employees. There is no exemption for paying the Federal Insurance Contribution Act FICA payroll taxes that fund the Social. Most people are not aware that Social Security contributions are capped at the first 147000 of wage income.

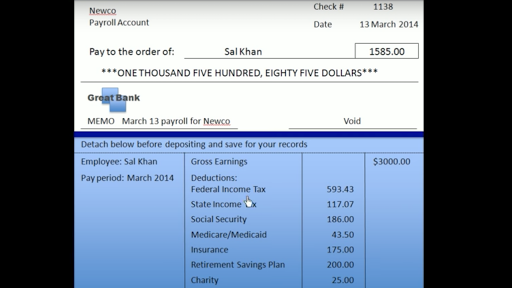

Most employers must comply with the act by deducting Social Security tax from your paycheck and paying the employer portion as well. However you only pay half of this amount or 62 out of your. FICA includes both Social Security and.

There are several reasons social security tax was not withheld from your paycheck. Do you have to have Social Security taken out of your paycheck. How Much Social Security Tax Gets Taken Out of My Paycheck.

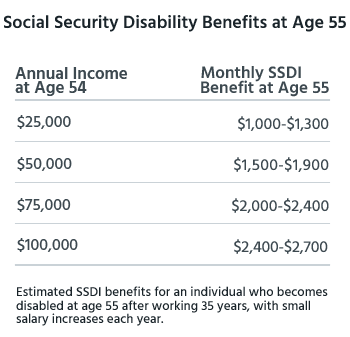

Each year the federal government sets a limit on the amount of earnings subject to Social Security tax. Perhaps the most mainstream way to get out of paying FICA tax is a religious clause. Up to 15 cash back I am on Social Security disability I take home 814 a month i owe arreages on child support my child has been an adult for 30 years California 12500.

If your annual gross wages are 20000 your FICA deductions for the year total 1530. Social Security and Medicare Tax. Members of recognized religious organizations opposed to the collection of Social Security benefits can.

Ad Ready to Retire. Complete an Online Retirement Benefit Application In As Few As 15 Mins. FICA mandates that three separate taxes be withheld from an.

If you work for an employer your paycheck will likely show an amount withheld for FICA the Federal Insurance Contributions Act. Your employer most likely takes federal income tax Social Security tax Medicare tax and state income tax out of your. These payroll taxes are taken directly out of an employees paycheck and are paid by both employees and.

That means that someone who earns 1000000 per year stops paying into the. However you only pay half of this amount or 62 out of your paycheck -- the other half is paid by your. The Social Security tax rate in the United States is currently 124.

The Social Security portion of your annual FICA payment equals 1240. If youre younger than full retirement age during all of 2020 the Social Security Administration will deduct 1 from your Social Security paycheck for every 2 you earn above. You are a degree-seeking student in good standing attending school at least 12.

But once the deferral ends those taxpayers will be. First off Social Security is funded through payroll tax deductions. As of 2021 your wages up to 142800 147000 for 2022 are taxed at 62 for Social Security and your wages with no limit are taxed at 145 for Medicare.

There is no exemption for paying the Federal Insurance Contribution Act FICA payroll taxes that fund. Updated October 08 2018. In 2022 the Social Security tax limit is 147000 up from 142800 in.

Unlike ordinary federal income tax brackets which tax higher incomes at a. The question of how often is Social Security health insurance taken out of a paycheck is a common one but few workers actually understand it. Should Social Security be taken out of my paycheck.

By Grace Ferguson.

Anatomy Of A Paycheck Video Paycheck Khan Academy

How To Get The Maximum Social Security Benefit Smartasset

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

Social Security Tax Definition

What Is Fica Tax Contribution Rates Examples

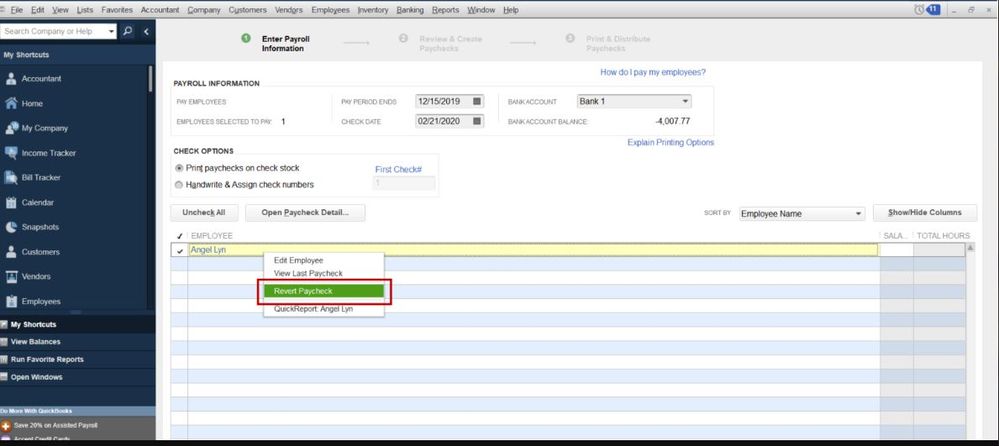

Is There A Way To Print A Social Security Number On The Pay Stub

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

What Is Fed Med Ee Tax

What To Do When Excess Social Security Tax Is Withheld Stanfield O Dell Tulsa Cpa Firm

Solved No Medicare Or Social Security Tax Taken Out Of One Employee S Check

Understanding Your Paycheck Credit Com

Understanding Your Paycheck

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

How Much Can You Get In Social Security Disability Benefits Disabilitysecrets

Irs Releases Instructions For Forms W 2 And W 2c Reporting Of Employee Deferral And Repayment Of Social Security Taxes Under Irs Notice 2020 65

Different Types Of Payroll Deductions Gusto

Paycheck Taxes Federal State Local Withholding H R Block